Term Insurance

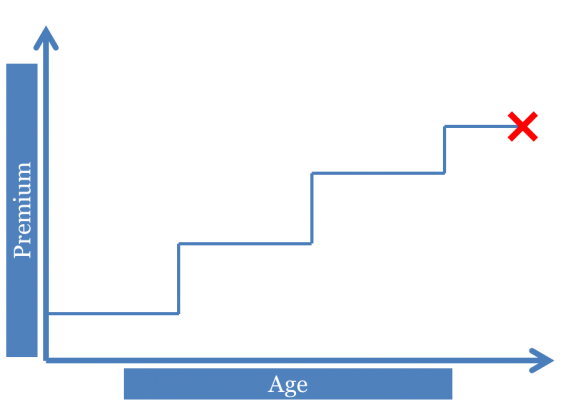

Term insurance is the most cost effective tool to get the right amount of insurance in place without creating a burden on cash flow, especially when building a family and career. It provides temporary protection for temporary needs. Although it may be temporary it is important to ensure that the product has certain provisions that give flexibility in the future, so you can adjust your insurance as your needs change.

Term insurance is the most cost effective tool to get the right amount of insurance in place without creating a burden on cash flow, especially when building a family and career. It provides temporary protection for temporary needs. Although it may be temporary it is important to ensure that the product has certain provisions that give flexibility in the future, so you can adjust your insurance as your needs change.

Term life insurance is a popular choice for:

- Individuals starting to build a family

- An alternative to Mortgage insurance

- Covering any type of short term debt

- Individuals focused on affordability and flexibility

- Small business owners facing debts or significant start-up costs

- Business owners with complex needs like key person protection or funding buy/sell agreements

What’s the difference between Mortgage Insurance and Term Insurance?

Canadian lending institutions are obligated to offer some type of creditor insurance to individuals taking out a personal loan or mortgage. Unfortunately this type of coverage is not an effective product for what it is intended to do. For example, the individual does not have the opportunity to choose their beneficiary. The lender receives the benefit in the event of death. The biggest downside to coverage offered by lenders is that it is not a guaranteed product. The lender has the option to change or cancel the plan at any time (even after death has occurred).

Term insurance is an excellent alternative to Mortgage Insurance. The individual owns the policy personally and can name a beneficiary. The beneficiary can direct the funds as they see best. They may want to pay off the entire balance of the mortgage, or continue to make regular payments and direct the funds elsewhere. Term insurance is guaranteed and non-cancellable so once the policy is put in force it can only be modified by the policy holder. Term insurance is generally less expensive since creditor insurance often uses blended rates, meaning smokers and non-smokers are combined. With term insurance, non-smoking, healthy people can qualify for lower rates.

The most important factor is that generally the advisor who assists in setting up a mortgage or line of credit is not trained in life insurance or financial planning.